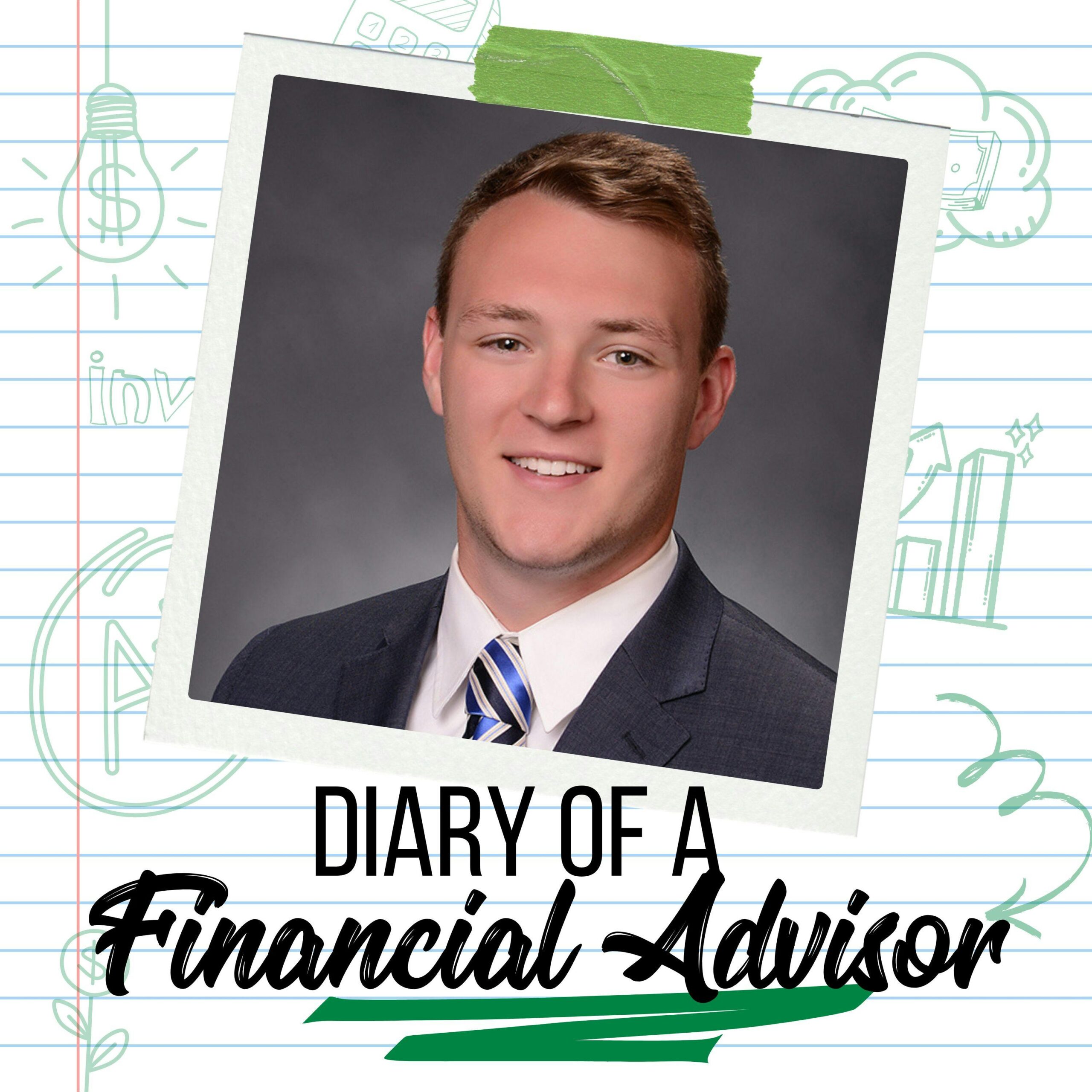

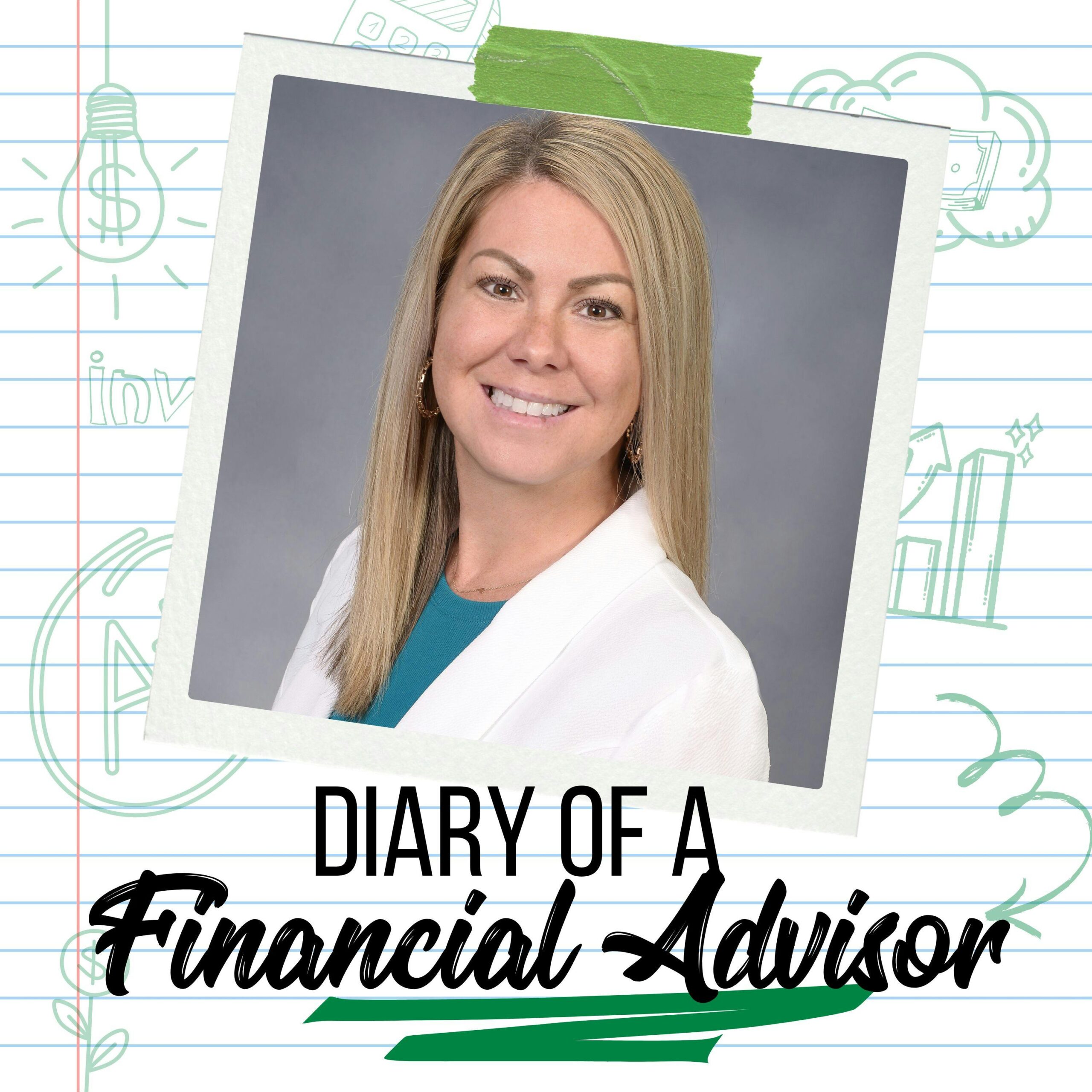

Empowering Client Success: Kirby Ososki on the Heart of Financial Services

Welcome back to another Diary of a Financial Advisor segment of Don’t Retire… Graduate! . Our special guest is Kirby Ososki, a remarkable individual with 18 years of experience in the financial industry, currently working at BFG—not as a financial advisor, but as a Registered Client Service Associate. Kirby brings a distinct perspective to our …