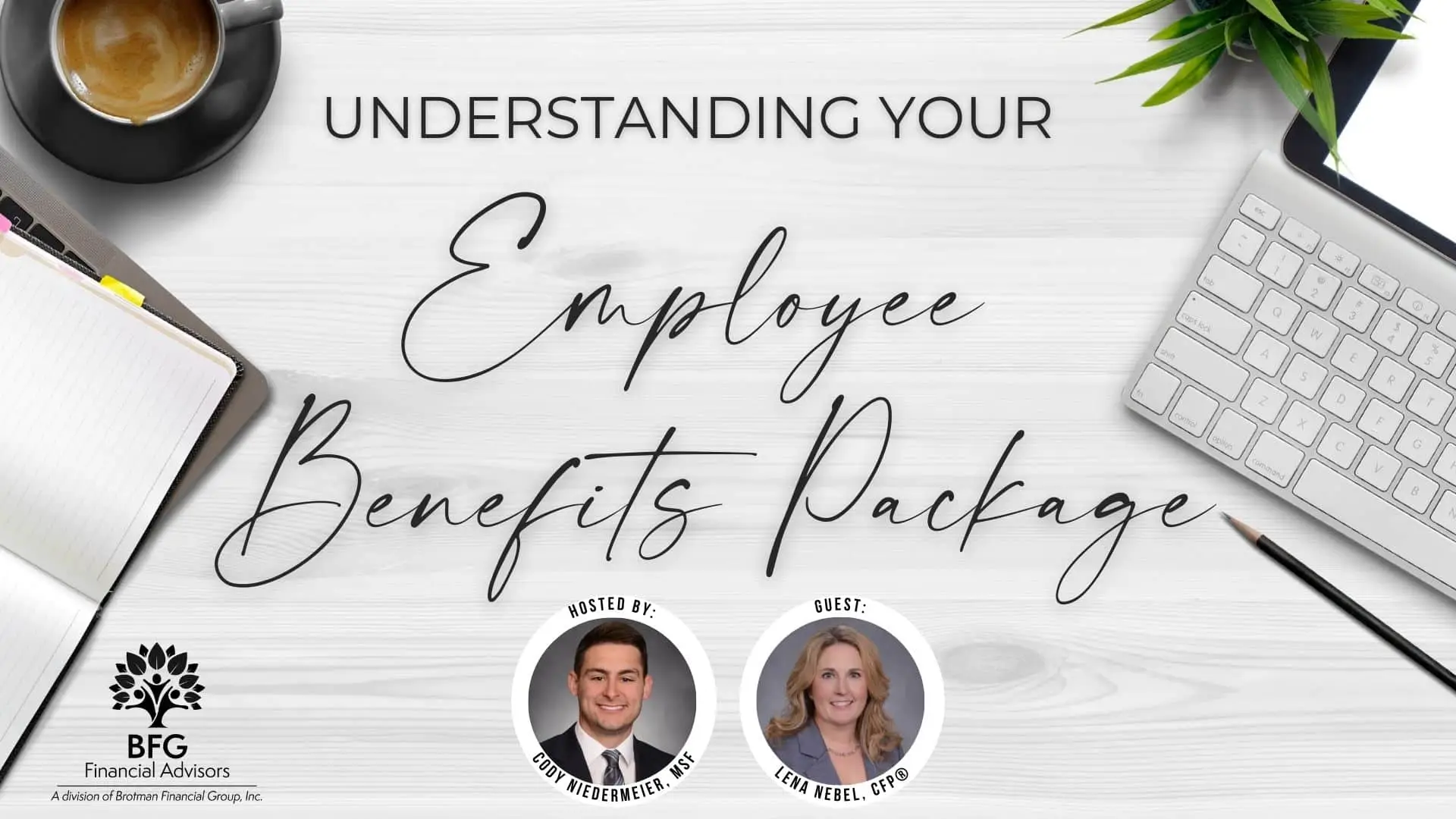

Understanding Your Employee Benefits Package

Understanding Your Employee Benefits Package Starting a new job is exciting, but what are all those papers that HR just handed you? Join Cody Niedermeier and Lena Nebel for a one-hour webinar that explains everything you can expect to see in your employee benefits package including: Retirement accounts like 401(k)s and 403(b)s Wellness programs to …